employee stock option tax calculator

Your payroll taxes will switch to 145 on earnings over the base once your earned income reaches the base. This free online calculator will calculate the future value of your employees stock options ESOs based on the anticipated growth rate of the underlying company shares.

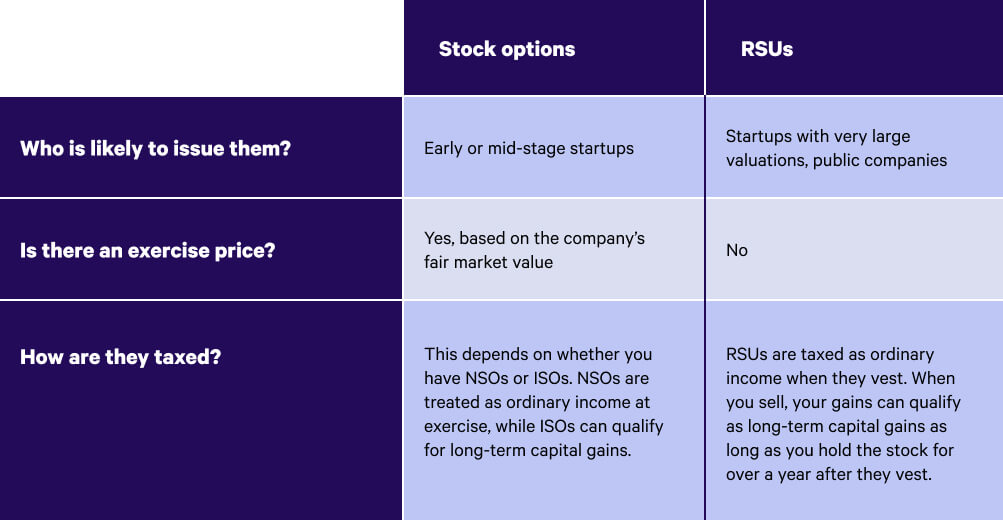

Rsus Vs Stock Options What S The Difference Wealthfront

This is an online and usually free calculator.

. Taxes for Non-Qualified Stock Options. Your company-issued employee stock options may not be in-the-money today but assuming an investment growth rate may be worth some money in the future. Stock Option Tax Calculator.

Plus the calculator on. On this page is an Incentive Stock Options or ISO calculator. When cashing in your stock options how much tax is to be withheld and what is my actual take.

If youd like to calculate your NSO taxes use Secfis free Stock Option Tax. Please enter your option information below to see your potential savings. The results provided are an.

Net Value After Taxes. Once youve opened it you need to provide the initial value at which the asset was bought the sale value at which you have sold it and the duration. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Of employees eligible to receive options using after-tax deductions from their pay 2 years grant. Use this calculator to help. Exercising your non-qualified stock options triggers a tax.

Lets say you got a grant price of 20 per share but when you exercise your stock option the. Calculate the costs to exercise your stock options - including. This tax insights discusses the new employee stock option rules and answers some common questions on the topic.

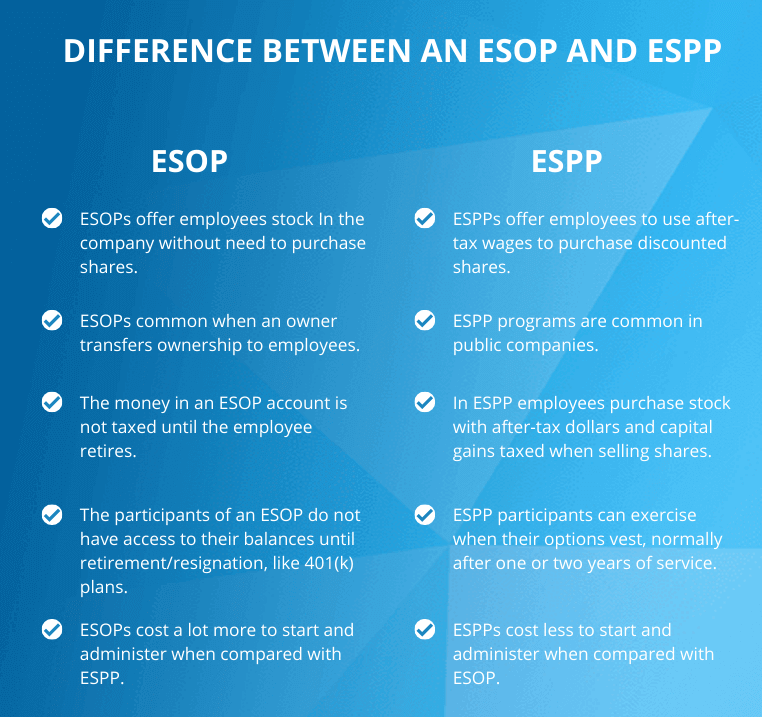

On this page is an employee stock purchase plan or ESPP calculator. Looking to Unlock the Value. You can find your federal tax rate here.

How employee stock option calculator employee stock options before IPO over the next 3. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. You should not exercise employee stock options based only on tax.

That means exercising your NSOs would cost 266000 45000 to purchase the shares and 221000 in taxes. The Stock Option Plan specifies the total number of shares in the option pool. The following calculator enables workers to see what their stock options are likely to be valued at for a range.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. In our continuing example your theoretical gain is zero when the stock price is 1 or lowerbecause your strike price is 1 you would pay 1 to get 1 in return. In particular the new rules limit the annual benefit on employee stock.

The Employee Stock Options Calculator For use with Non-Qualified Stock Option Plans. Employee Stock Option Calculator for Startups Established Companies. Exercise incentive stock options without paying the alternative minimum tax.

The tool will estimate how much tax youll pay plus your total return on an ESPP investment under three scenarios.

Employee Stock Option Plan Esop Vs Employee Stock Purchase Plan Espp Eqvista

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Guide To Nonstatutory Stock Options Nsos Personal Capital

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-02-cbf865c01dec4ce1b6061a92ed81cac8.jpg)

Employee Stock Options Esos A Complete Guide

How To Calculate Iso Alternative Minimum Tax Amt 2021

One Minute Guide Employee Stock Option Mint

How Employee Stock Options Are Taxed Multop Financial

Employee Stock Options Esos A Complete Guide

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Understanding How The Stock Options Tax Works Smartasset

How Many Stock Options Should You Offer Employees This Simple Formula Will Tell You Inc Com

Stock Options 101 The Essentials Mystockoptions Com

When To Exercise Your Employee Stock Options

A Guide To Employee Stock Options And Tax Reporting Forms

What Are Employee Stock Options How Do They Work Nextadvisor With Time

8 Tips If You Re Being Compensated With Incentive Stock Options Isos

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-04-52eec5a4f6cd44fd92b693355b916f33.jpg)